Home Equity

-

How to Maximize Your Home Equity with Smart Financial Planning

Introduction Home equity is one of the most powerful financial assets you can build as a homeowner. By strategically managing your home equity, you can leverage it for various financial goals, from home improvements to retirement planning. In this article, we’ll explore how to maximize your home equity through smart financial planning. Understanding Home Equity […]

February 9, 2025 -

5 Smart Ways to Use Home Equity for Home Improvements

Introduction Home equity is a valuable asset that homeowners can leverage to make meaningful improvements to their property. By tapping into your home’s equity, you can fund renovations that not only enhance your living space but also increase the overall value of your home. In this guide, we’ll explore five smart ways to use home […]

February 9, 2025 -

Exploring the Benefits of Home Equity: Is it Right for You?

Introduction Home equity is one of the most valuable financial resources available to homeowners. It represents the portion of your property that you own outright and can be leveraged for various financial goals. In this comprehensive guide, we’ll explore the benefits of home equity, how to access it, and factors to consider to determine if […]

February 9, 2025 -

How to Find the Right HELOC Alternative

Understanding HELOCs Home Equity Lines of Credit (HELOCs) have long been a popular financing option for homeowners looking to access the equity in their homes. A HELOC allows you to borrow against the value of your home, providing a flexible line of credit that you can draw from as needed. However, HELOCs are not always […]

February 7, 2025 -

How to Pay Off a HELOC Faster

Introduction A Home Equity Line of Credit (HELOC) can be a flexible and convenient way to access funds for various financial needs, from home improvements to debt consolidation. However, like any loan, it’s essential to manage it wisely and aim to pay it off as quickly as possible to minimize interest costs. This guide will […]

February 7, 2025 -

HELOC vs. 401(k) loan: How to choose

Understanding HELOCs and 401(k) Loans When it comes to borrowing money, two popular options are Home Equity Lines of Credit (HELOCs) and 401(k) loans. Both have their pros and cons, and the best choice depends on your financial situation and goals. Let’s explore the differences between these two options to help you make an informed […]

February 7, 2025 -

Home equity loan vs. mortgage: How are they different?

Navigating the world of home financing can be complex, especially when faced with terms like home equity loans and mortgages. While both options allow you to leverage the value of your home, they serve different purposes and come with distinct features. Understanding these differences is crucial for making an informed decision that aligns with your […]

February 7, 2025 -

How to get a home equity loan with high DTI

Understanding Debt-to-Income Ratio Before diving into the process of obtaining a home equity loan with a high debt-to-income (DTI) ratio, it’s important to understand what DTI is and why it matters. The DTI ratio measures your monthly debt payments against your gross monthly income. It’s a critical factor lenders consider when assessing your ability to […]

February 7, 2025 -

If I refi my home, can I keep my HELOC?

Understanding HELOCs and Refinancing Home Equity Lines of Credit (HELOCs) provide homeowners with a flexible line of credit based on the equity in their homes. This credit can be used for various purposes such as home improvements, debt consolidation, or other major expenses. Refinancing your home, on the other hand, involves replacing your existing mortgage […]

February 7, 2025 -

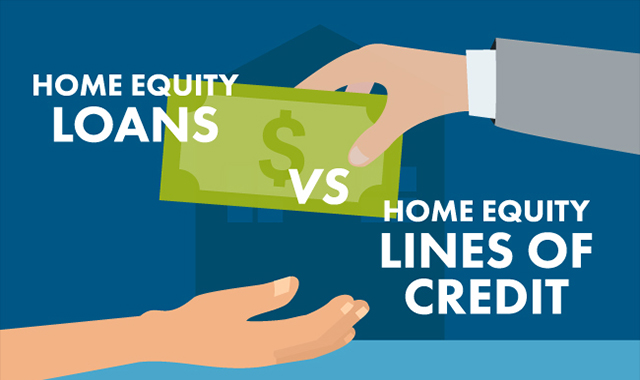

Home Equity Loans vs. Home Equity Lines of Credit (HELOC): Which One Should You Choose?

Introduction When it comes to tapping into your home equity for financial needs, you have two primary options: Home Equity Loans and Home Equity Lines of Credit (HELOC). Both of these financial products allow you to borrow against the value of your home, but they come with different terms, uses, and advantages. In this comprehensive […]

February 9, 2025

- « Previous

- 1

- 2

- 3

- 4

- Next »