Home Equity

-

Can I get a home equity loan without an appraisal?

Home equity loans are a popular financing option for homeowners looking to leverage the equity in their homes for various purposes, such as home improvements, debt consolidation, or major purchases. One common requirement when applying for a home equity loan is a home appraisal, which determines the current market value of your property. However, many […]

February 7, 2025 -

10 Things Every Homebuyer Should Know Before Making an Offer

Buying a home is one of the most significant decisions you will ever make. It’s a complex process that requires careful consideration and planning. Before making an offer, it’s essential to be well-informed and prepared. In this guide, we’ll cover ten crucial things every homebuyer should know to ensure a smooth and successful home purchase. […]

February 11, 2025 -

Is Home Equity the Key to Funding Your Retirement? Here’s What You Should Know

Introduction Retirement planning is a critical aspect of financial management, and for many homeowners, home equity plays a significant role in their retirement strategy. Home equity, the difference between the current market value of your home and the outstanding balance on your mortgage, can be a valuable resource for funding your retirement. In this comprehensive […]

February 9, 2025 -

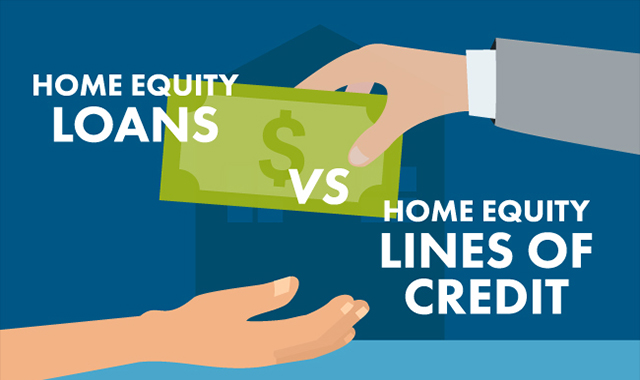

Home Equity Loans vs. Home Equity Lines of Credit (HELOC): Which One Should You Choose?

Introduction When it comes to tapping into your home equity for financial needs, you have two primary options: Home Equity Loans and Home Equity Lines of Credit (HELOC). Both of these financial products allow you to borrow against the value of your home, but they come with different terms, uses, and advantages. In this comprehensive […]

February 9, 2025 -

Top Strategies for Increasing Your Home Equity in a Competitive Market

Introduction In a competitive real estate market, building home equity is crucial for financial stability and long-term investment growth. Home equity not only enhances your net worth but also provides you with valuable financial leverage. In this comprehensive guide, we’ll explore the top strategies for increasing your home equity, ensuring that you make the most […]

February 9, 2025 -

How to Tap Into Your Home Equity Without Risking Your Property

Introduction Home equity is a significant financial asset that can provide homeowners with the funds needed for major expenses. However, tapping into home equity comes with risks, particularly the possibility of losing your property if you fail to make payments. In this comprehensive guide, we’ll explore strategies for accessing your home equity safely, ensuring that […]

February 9, 2025 -

No Income Verification Home Loans: A Guide to Your Options

Securing a mortgage can be a daunting task, particularly for those who don’t have a traditional source of income or have an irregular earning pattern. Fortunately, no income verification home loans provide a viable solution for these individuals. This guide will delve into the details of these loans, offering valuable insights, tips, and guidance on […]

February 7, 2025 -

Exploring the Benefits of Home Equity: Is it Right for You?

Introduction Home equity is one of the most valuable financial resources available to homeowners. It represents the portion of your property that you own outright and can be leveraged for various financial goals. In this comprehensive guide, we’ll explore the benefits of home equity, how to access it, and factors to consider to determine if […]

February 9, 2025 -

Are student loans considered as debt when getting a HELOC?

Understanding Home Equity Lines of Credit (HELOC) Home Equity Lines of Credit (HELOCs) are a popular financing option for homeowners who want to leverage the equity in their homes. HELOCs provide a flexible line of credit that can be used for various purposes, such as home improvements, debt consolidation, or other major expenses. However, when […]

February 7, 2025 -

If I refi my home, can I keep my HELOC?

Understanding HELOCs and Refinancing Home Equity Lines of Credit (HELOCs) provide homeowners with a flexible line of credit based on the equity in their homes. This credit can be used for various purposes such as home improvements, debt consolidation, or other major expenses. Refinancing your home, on the other hand, involves replacing your existing mortgage […]

February 7, 2025

- « Previous

- 1

- 2

- 3

- 4

- Next »